- Advertisement -

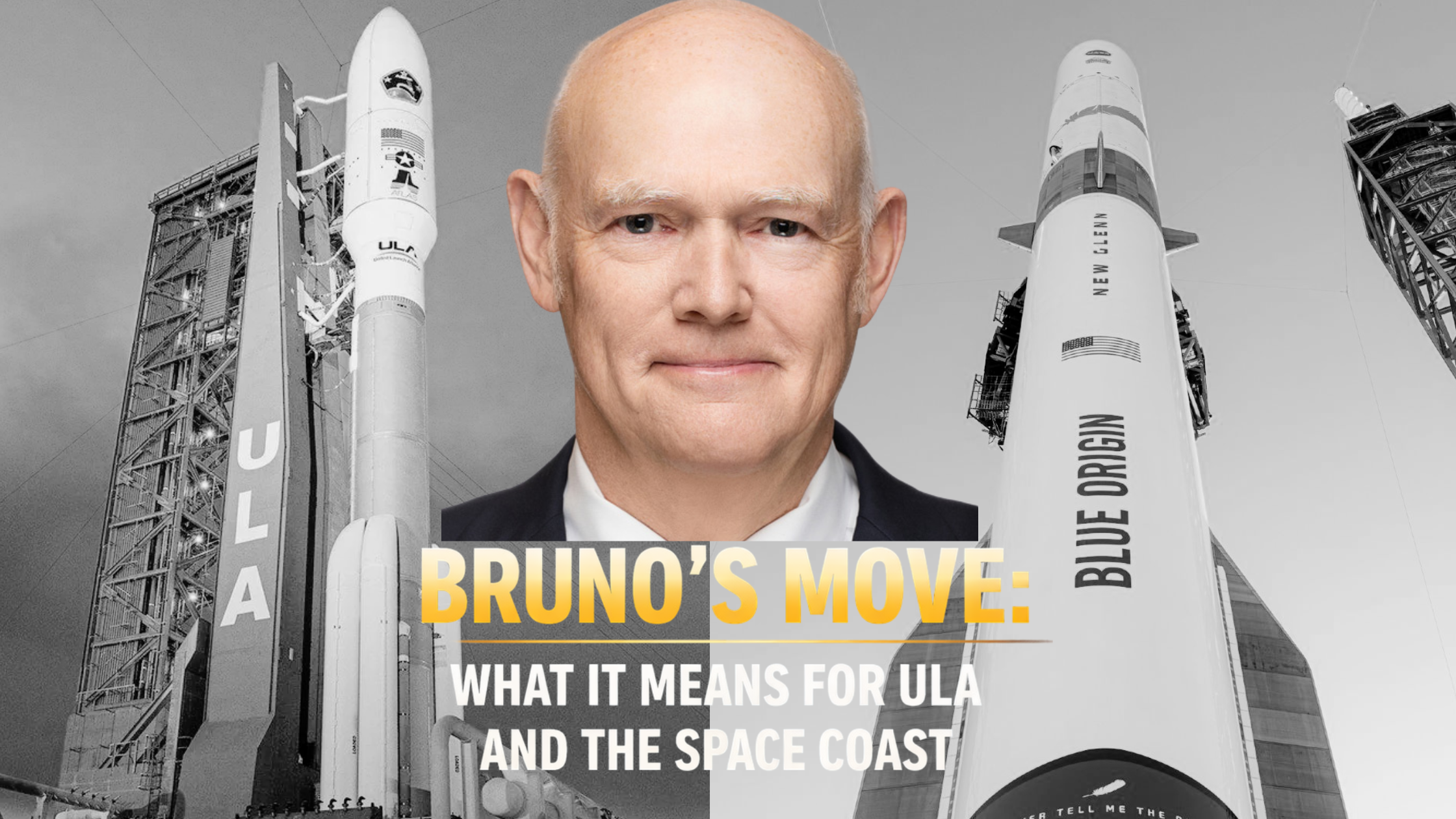

Tory Bruno stepped down after nearly 12 years leading United Launch Alliance, then reappeared days later at Blue Origin to run a newly formed national security group. The headline is executive drama. The real story is how Florida is becoming the center of gravity for the next phase of national security launches, and what ULA has to prove next.

BREVARD COUNTY, Fla. – United Launch Alliance confirmed on Dec. 22 that longtime CEO Tory Bruno resigned “to pursue another opportunity,” with ULA naming John Elbon as interim CEO while the company searches for a permanent successor.

- Advertisement -

Four days later, Blue Origin announced Bruno is joining the company as president of its newly formed National Security Group, reporting to CEO Dave Limp.

That jump is notable on its own. It is also unusually consequential because ULA and Blue Origin are not just competitors. They are also connected through hardware. Blue Origin’s BE-4 engines power ULA’s Vulcan rocket, which Bruno championed as ULA’s replacement for Atlas V and Delta IV and as the backbone of ULA’s next decade of national security work.

- Advertisement -

What this means for ULA’s future, beyond the headline

ULA’s near-term future is about one thing: execution at higher tempo.

Bruno’s tenure was defined by transformation and transition, including retiring legacy systems and pushing Vulcan into operational reality. Now, ULA has to prove it can scale.

- Advertisement -

That scaling challenge is not theoretical. ULA is still flying Atlas V to meet commitments, including launching batches of Amazon’s Project Kuiper satellites from Cape Canaveral, even as Vulcan becomes the go-forward platform. The company is also trying to position Vulcan to stay relevant in a market where the winning currency is cadence, not just capability.

In late 2024, Reuters reported ULA was studying upgrades to make Vulcan more competitive in high-volume launch markets, and that the company had a large backlog and ambitious launch plans. A CEO transition in the middle of that kind of ramp can be either a stumble or a catalyst, depending on how quickly ULA locks in permanent leadership and how aggressively it executes the next year of launches.

What Blue Origin is really buying with Bruno

Blue Origin is not just hiring a recognizable name. It is hiring a national security translator.

The Pentagon and intelligence community do not buy rockets the way commercial customers do. The expectations are different: mission assurance culture, certification pathways, operational discipline, and the ability to deliver repeatedly under tight security and tight timelines.

Blue Origin is openly building a business unit around that reality, and Reuters described Bruno’s role as leading Blue Origin’s national security operations as it expands into defense and intelligence launch markets.

This is also happening while Blue Origin’s Florida footprint is designed for repeated operations. The company describes New Glenn as built, integrated, launched, and refurbished within a tight radius centered on its manufacturing complex at Exploration Park near Kennedy Space Center.

The Space Coast angle most coverage is missing

Most stories are framing this as “competitors swap leaders.”

For Brevard, the more interesting frame is this: Florida is turning into a two-pad corridor for the next era of national security launch competition.

- ULA’s East Coast home for Atlas V and Vulcan is Space Launch Complex 41 at Cape Canaveral Space Force Station.

- Blue Origin’s New Glenn launches from Space Launch Complex 36 at Cape Canaveral.

That matters because the Space Force has already mapped out a future where multiple providers share the national security manifest. In its Phase 3 Lane 2 contracting approach, Space Systems Command projected mission allocations across SpaceX, ULA, and Blue Origin, with Blue Origin positioned for a smaller but meaningful share starting later in the cycle.

Those missions will not all launch from the Space Coast (some require polar orbits typically flown from California), but many high-value missions do fly from Florida depending on orbit and customer needs. The practical outcome is increased pressure on Cape infrastructure, range scheduling, and the local workforce that supports launch ops, payload processing, and security-heavy campaigns.

If Blue Origin accelerates its certification and cadence for national security missions, and if ULA ramps Vulcan while still finishing Atlas V obligations, the Cape could see more frequent periods where two different heavy-lift teams are cycling through major missions in parallel. That is not just more launches. That is more “launch campaigns,” the weeks-long waves of activity that fill hotels, move specialized cargo, and drive demand for skilled labor and support services across the Space Coast.

The weird twist: this could help the Cape even if it hurts ULA

There is a counterintuitive possibility here.

Even if Bruno’s move intensifies competition for missions, it can still strengthen the Space Coast’s strategic importance. National security customers want resiliency, meaning more than one provider that can actually deliver. If Blue Origin becomes a true operational peer in that market, more of the nation’s highest-priority launch work will flow through Cape Canaveral’s ecosystem.

In other words, the Space Coast wins when the Cape becomes the default stage for multiple national security launch providers, not just one.

What to watch next, if you live here

- Who becomes ULA’s permanent CEO, and whether ULA signals continuity or a strategic reset after the interim period.

- Vulcan’s cadence from SLC-41, especially as national security missions stack up and Atlas V winds down.

- Blue Origin’s New Glenn operational tempo from SLC-36, and how quickly national security requirements are translated into repeatable flight operations.

- How the Space Force’s Phase 3 mission ordering plays out, because that will shape which provider is busiest at the Cape in the late 2020s.

Bottom line for Brevard

Tory Bruno leaving ULA is not just a leadership change. It is a signal that the national security launch market is entering a new phase where Blue Origin is pushing hard to become “real” in a category that has historically been dominated by ULA and SpaceX.

If that push works, the Space Coast likely sees more high-security launch campaigns, more range demand, and more of the country’s most consequential payloads routing through Cape Canaveral.

- Advertisement -