Hurricane season in Florida is more than just a date on the calendar—it’s a high-stakes period where preparation can mean the difference between financial stability and tens of thousands in unexpected costs. If you’re a homeowner, one of the most overlooked but crucial steps in storm preparedness is speaking with a licensed public adjuster before the next hurricane strikes.

Why Pre-Storm Damage Matters

If you’ve noticed water stains on the ceiling, loose roof shingles, or other signs of damage, it’s critical to have them assessed now—especially if they stem from a thunderstorm, hail, or tropical storm. Here’s why:

Most homeowner policies have a much lower deductible for non-hurricane storm damage compared to hurricane-related claims. If you wait until a hurricane makes landfall, pre-existing storm damage becomes part of your hurricane claim—and that means the hurricane deductible applies.

In Florida, hurricane deductibles typically range from 1% to 5% of your home’s insured value. For a $400,000 home with a 5% deductible, that’s $20,000 out of pocket before insurance kicks in. In contrast, damage from other storms often falls under the All Other Perils deductible, which can be as low as $500.

Brevard County communities like Palm Bay, Melbourne, Viera, Cocoa, Merritt Island, Titusville, and the beachside towns from Cape Canaveral to Melbourne Beach may already have roofs or siding with unaddressed damage from past storms—damage that could be covered now under a lower deductible.

Documenting Damage Before the Storm

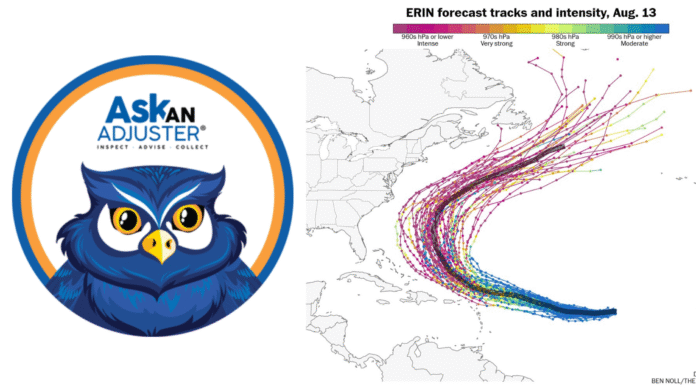

“Taking pictures of your property before a hurricane can prove that damage existed before the storm,” explains Kevin Downs of Ask An Adjuster. “That documentation allows homeowners to file under their standard deductible instead of their hurricane deductible—saving potentially tens of thousands of dollars.”

Example:

A Cocoa Beach homeowner with roof damage from a tropical storm could file now under the standard deductible. If that same roof is left unrepaired and a hurricane worsens the damage, the higher hurricane deductible would apply.

A public adjuster can inspect, document, and help file these pre-storm claims to ensure they’re handled correctly and that you receive the maximum settlement you’re entitled to.

The One-Year Claim Deadline

Many homeowners don’t realize there’s a time limit for filing hurricane claims. We’re now approaching the one-year deadline for claims from Hurricane Milton, Hurricane Helene, and Hurricane Debbie. If you suspect your property was affected, get it documented now before that window closes.

What a Public Adjuster Does (and Why It Matters)

Unlike insurance company adjusters, who represent the insurer, public adjusters are licensed professionals hired by you to represent your interests. They:

- Assess and document property damage

- Interpret policy coverage

- Prepare and file claims

- Negotiate with the insurance company

Data from the Florida Legislature’s Office of Program Policy Analysis and Government Accountability (OPPAGA) shows that policyholders with public adjusters on hurricane-related claims receive 747% more money than those without. For non-catastrophic claims, the average increase is 574%.

Real Results for Florida Homeowners

- Palm Bay Case: Homeowner’s storm damage claim was initially deemed below deductible. After hiring Ask An Adjuster, they received a full roof replacement and compensation for interior damage.

- Hurricane Ian Case: A condo association was told its damages were below the deductible. With Ask An Adjuster’s help, they secured millions for roofs and window replacements.

- Cape Coral Case: Jack and Marin’s insurance company offered $31,000 for hurricane damage. With Ask An Adjuster, the settlement rose to nearly $200,000—enough to cover all repairs.

Protecting Yourself from Underpaid or Denied Claims

A Washington Post investigation found that some Florida insurers cut hurricane payouts by as much as 97%. Public adjusters counter these tactics with detailed assessments, ensuring you get a fair settlement. They can also reopen underpaid or denied claims for up to 18 months.

Cost, Consumer Protections, and Licensing

Public adjusters in Florida typically charge 10%–20% of the settlement, but state law caps the fee at 10% for residential claims filed within a year of a declared state of emergency. Considering the massive increase in average payouts, the fee often more than pays for itself.

The Florida Department of Financial Services (DFS) licenses and regulates public adjusters, and homeowners can verify licenses at licenseesearch.fldfs.com.

Final Word from Ask An Adjuster

“When you’re faced with storm damage, having an expert on your side changes everything,” says Kevin Downs. “From the first inspection to the final settlement, we fight to make sure you’re not left paying for repairs out of pocket that your policy should cover.”